In the ever-expanding theater of Elon Musk’s high-risk, high-reward ventures, Starlink has been the brightest new star—a dazzling constellation of satellites beaming internet to the most remote corners of the planet. With revenues projected to reach $12.3 billion in 2025, it would be easy to assume the mission is on an unstoppable upward trajectory.

But in the world of private valuations, mounting expenses, and capital-intensive infrastructure, strong revenue does not always equate to financial stability. In fact, despite the impressive topline figure, experts are warning that the future of SpaceX—and by extension, Starlink—may be hanging in the balance.

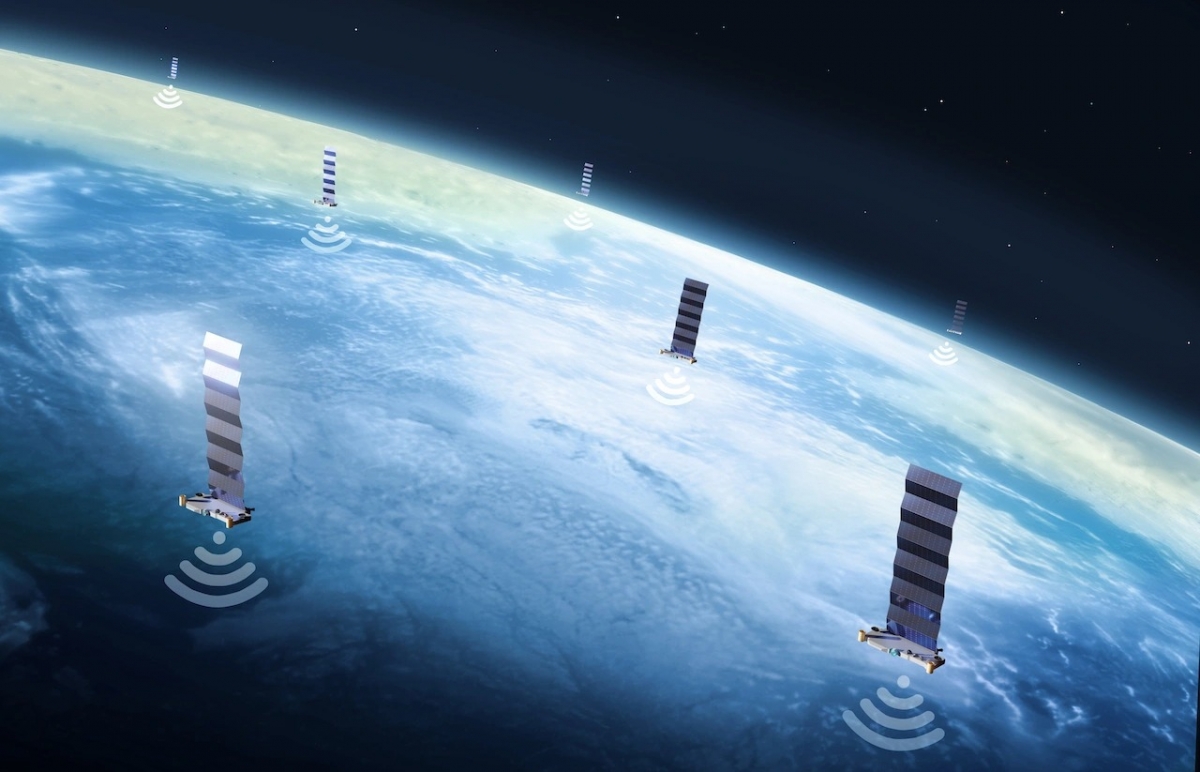

According to a recent report by Forbes, Starlink has grown into one of the most ambitious commercial satellite internet projects in history. With more than 2.6 million customers across 75 countries, and over 5,500 satellites currently orbiting the Earth, the program has achieved technological feats once thought to be decades away.

And yet, the financial underpinnings of this grand endeavor remain far less stable than the optics suggest.

Chris Quilty, a veteran space industry analyst and founder of Quilty Space, estimates that Starlink’s revenues will jump by 58% in 2025, reaching $12.3 billion, up from $7.8 billion in 2024. This growth is attributed to expanding consumer adoption, especially in underserved regions, and new revenue from enterprise and government contracts.

However, profitability remains elusive. Despite the billions in revenue, the cost of deploying, maintaining, and replacing tens of thousands of satellites is enormous. Each Starlink satellite has a limited lifespan—about five to seven years—after which it must be replaced. Launches, ground infrastructure, user terminals, and global customer support all compound the capital burden.

Even with SpaceX’s vertically integrated model and cost-saving innovations like reusable rockets, the economics of Starlink remain deeply challenging. Musk himself has acknowledged that Starlink must overcome a “deep chasm of negative cash flow” before becoming sustainably profitable.

Starlink isn’t just a line item in SpaceX’s portfolio—it’s the company’s financial cornerstone. Industry estimates suggest that Starlink now accounts for roughly 60% of SpaceX’s total valuation, which stands at an eye-watering $180 billion. That pegs Starlink’s implied worth at $108 billion, a figure built largely on expectations of rapid global expansion, margin improvement, and—crucially—an eventual IPO.

But what happens if those expectations fall short?

Analysts warn that if Starlink fails to prove profitability in the near term, or if its IPO timeline continues to be delayed, investor confidence could waver, triggering a reassessment of its market value. In such a scenario, Starlink’s valuation could drop by 20–40%, translating into a potential loss of up to $43 billion.

That would represent one of the largest single-event markdowns in private tech investment history—and it would rattle confidence across Musk’s entire business empire.

While revenue is on the rise, the bottom line remains murky. Starlink has made strides in reducing hardware costs—bringing the price of user terminals down from about $1,500 to closer to $500—but many are still sold below cost.

That means each new subscriber, while helpful in growing the user base, may not be significantly contributing to net income in the short term.

Moreover, the consumer internet market in developed countries—where higher prices could improve margins—is largely saturated with fiber and 5G solutions. In underserved areas where Starlink shines, customers are more price-sensitive, and service is often subsidized to improve accessibility.

The company has begun pivoting to enterprise services such as in-flight Wi-Fi, maritime coverage, and defense applications, which carry better margins. However, this transition is still in early stages and faces stiff competition from legacy providers and emerging satellite operators.

A public offering for Starlink has long been anticipated, with Musk hinting at a spinout once cash flow stabilizes. Such an IPO would not only provide liquidity to SpaceX investors, but also serve as a key inflection point in validating the business model.

But Wall Street is no longer as eager to bet on moonshots. The IPO environment has cooled significantly in the post-SPAC era, and market sentiment has shifted toward companies with proven profitability.

Starlink’s current financials and aggressive capital expenditures could make a public debut risky, both in terms of valuation and post-IPO performance.

Delaying the IPO could buy time for the business model to mature—but it also increases pressure. The longer Starlink remains private without showing profits, the more fragile its valuation becomes.

While Starlink was first to market with a functioning global satellite internet system, competition is heating up. Amazon’s Project Kuiper, backed by Jeff Bezos, plans to deploy 3,236 satellites and will begin beta testing in 2025. Other entrants, including OneWeb, Telesat, and Chinese state-backed programs, are also rapidly developing constellations.

As rivals close the technological gap, Starlink’s pricing power may erode. Additionally, new players may enjoy regulatory or geopolitical advantages in certain regions, especially in markets where SpaceX has faced resistance due to its American origin or perceived military applications.

This intensifying competition could limit Starlink’s global footprint and cap its addressable market just as it attempts to scale into profitability.

Operating a satellite constellation at this scale introduces significant regulatory and diplomatic complexity. Starlink has faced pushback in several countries over licensing, national security, and orbital crowding.

In some markets, services have been delayed or blocked outright due to unresolved frequency allocation disputes or geopolitical concerns.

The service’s involvement in conflicts—most notably in Ukraine—has also raised questions about its dual-use nature. While such engagements bring lucrative defense contracts, they also invite scrutiny and risk.

To keep Starlink—and by extension, SpaceX—on stable financial ground, several strategic pivots are essential:

-

Increase Profit Margins: This means reducing customer acquisition costs, transitioning to more profitable enterprise services, and possibly raising consumer prices in select markets.

-

Fast-Track Starship: Starship, SpaceX’s next-generation rocket, is designed to carry much larger payloads at dramatically lower costs. Once operational, it could significantly reduce the per-satellite launch expense.

-

Secure High-Value Contracts: Targeting military, government, and aviation clients could bring stable, high-margin revenue streams less sensitive to consumer pricing pressures.

-

IPO With Precision: If Starlink must go public, it needs to do so at the right time—when financials are strong enough to justify its sky-high valuation, and market conditions are favorable.

-

Manage Global Expansion Smartly: Focus should be on markets with the best regulatory alignment and economic upside, rather than blanket global coverage at all costs.

Starlink is, by all accounts, a technological triumph. It has revolutionized global internet access and pushed the limits of what private industry can achieve in space. But the economics of that achievement are far from settled.

$12.3 billion in revenue is a stunning headline, but it’s only one piece of a much more complicated puzzle. Without a path to profitability, a solid IPO strategy, and a sustainable cost structure, Starlink’s financial foundation—and SpaceX’s valuation—remain dangerously exposed.

The next 12 to 18 months will be pivotal. If Musk can steer Starlink into financial maturity, he will not only justify the hype but secure funding for SpaceX’s ultimate mission: colonizing Mars. If not, the company could face a hard landing—one that no rocket, no matter how reusable, can cushion.

-1745653838-q80.webp)

-1745766589-q80.webp)

-1744275017-q80.webp)