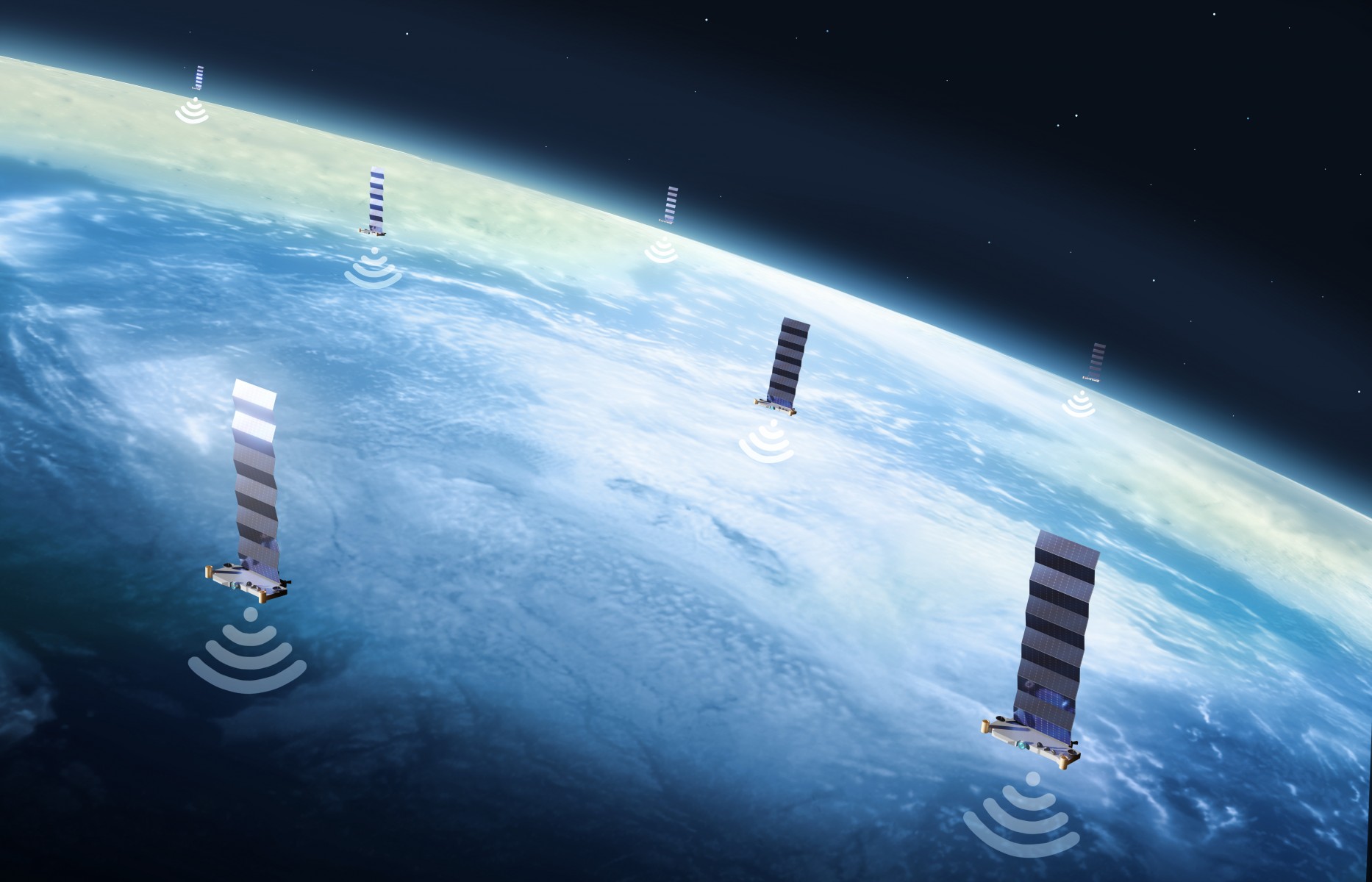

By all accounts, Elon Musk’s Starlink project has achieved remarkable technical and market milestones: over 2.6 million customers worldwide, an active constellation of more than 5,500 satellites in low Earth orbit, and a revolutionary expansion of internet access across previously unreachable geographies.

But beneath the surface of this aggressive space-based internet rollout lies a stark financial reality—one that threatens to slash up to $40 billion from SpaceX’s valuation if Musk doesn’t pivot quickly and strategically.

Starlink, the satellite internet service operated under Musk’s aerospace juggernaut SpaceX, is being touted as one of the most transformative broadband services since the dawn of fiber optics. With users in 75 countries and revenue expected to grow 58% this year to $12.3 billion, according to Quilty Space founder Chris Quilty, the numbers on the surface appear strong.

Yet, despite the headline-grabbing growth, there’s a critical caveat: profitability is still out of reach, and the unit economics of the business model remain precarious.

:max_bytes(150000):strip_icc()/GettyImages-2158701421-504a8868573a4bee932fd1df5c2ace14.jpg)

For all the billions in revenue, Starlink is likely still operating at razor-thin—or possibly negative—margins. Launching and maintaining a megaconstellation of thousands of satellites is immensely expensive.

SpaceX has already spent billions deploying satellites via its Falcon 9 rockets, and with the goal of growing the constellation to as many as 42,000 satellites, the costs are only compounding.

Moreover, many of these satellites require replacement after just five to seven years of operation due to orbital degradation and technological obsolescence.

According to industry analysts, SpaceX’s current private valuation sits around $180 billion. Starlink is believed to account for roughly 60% of that figure, or about $108 billion.

That high valuation is predicated on ambitious expectations: that Starlink will not only continue expanding its user base, but will do so profitably, with sustainable operating margins and a path to public listing via IPO in the near future.

But what happens if those expectations are not met?

If Starlink fails to demonstrate robust profitability or is unable to IPO in the expected timeframe, analysts warn that its value could be marked down sharply. Even a conservative markdown of 20% would erase more than $20 billion in value.

A more severe reassessment—say, 35% to 40%, based on lagging margins and capital expenditure pressure—could wipe out up to $40 billion of SpaceX’s valuation. That would not only be a blow to Musk’s broader space ambitions, but could also complicate funding for future projects like Starship, the Mars colonization vehicle, and interplanetary travel infrastructure.

Musk has long dangled the prospect of a Starlink IPO, both to generate liquidity and to give SpaceX investors a partial exit. But IPO markets are fickle, especially for capital-intensive tech plays that are not yet profitable.

The success of a Starlink IPO would hinge on Wall Street’s confidence in the company’s ability to turn a profit while continuing to scale globally.

Recent developments suggest Musk may be preparing the groundwork: Starlink has been operating more independently, with clearer financial tracking and leadership distinct from SpaceX's core operations. Still, there’s no public timetable, and any delay or failure in listing could be perceived as a red flag by current investors and would-be IPO buyers.

Starlink is no longer the only player in the satellite broadband space. Amazon’s Kuiper project is gearing up for large-scale deployment, and competitors in Europe and China are racing to develop their own satellite constellations.

While Starlink currently enjoys a first-mover advantage, that lead is narrowing. In wealthier, urbanized nations, consumer demand for satellite internet is relatively limited—most already have access to fast terrestrial broadband.

Starlink’s best markets are rural, underserved regions, which offer less profitability per user due to lower pricing sensitivity and higher hardware subsidies.

Furthermore, regulatory scrutiny is tightening. From concerns over orbital debris to national security worries about foreign access to Starlink infrastructure, geopolitical risks are escalating. This adds another layer of uncertainty to the project’s long-term valuation.

A key concern lies in the economics of the Starlink user terminal—the dish that consumers need to connect. While SpaceX has managed to bring the cost of producing each terminal down to around $500, it still heavily subsidizes the units, selling them at or below cost to accelerate adoption.

At one point, the terminals cost as much as $1,500 to produce.

Customer acquisition and retention are also expensive. Even with growing brand recognition, marketing Starlink in remote, low-density regions often requires significant effort and logistical complexity.

And churn remains a risk, particularly in markets where terrestrial broadband improves or where subsidies are reduced.

Elon Musk now stands at a crossroads. To avoid a catastrophic markdown in valuation, analysts argue he must take several urgent steps:

-

Push for Profitability: Starlink needs to demonstrate a clear path to profitability—either through better cost management, tiered pricing, or enterprise contracts (like maritime, aviation, and defense). The consumer-only model won’t carry the financial load alone.

-

Accelerate the IPO: By preparing Starlink for an IPO within the next 12–18 months, Musk can lock in investor confidence and realize partial liquidity before competitive and financial pressures mount.

-

Diversify Revenue Streams: Beyond internet subscriptions, Starlink has potential in data-as-a-service models, especially with government and military customers. Those higher-margin contracts could provide critical revenue padding.

-

Improve Unit Economics: Reducing production and launch costs further, possibly via Starship, could make the business more scalable. Starship's reusability, once fully operational, may be a game changer for lowering launch costs per satellite.

-

Strengthen International and Regulatory Strategy: Musk needs to proactively engage with global regulators to secure long-term licenses, frequency bands, and orbital slots. Otherwise, growth in crucial regions could be hampered.

For now, Elon Musk’s vision of blanketing Earth in high-speed satellite internet is alive—and arguably thriving from a technological perspective. But investors, competitors, and regulators are watching closely. With so much of SpaceX’s sky-high valuation tied to Starlink, any stumble in the broadband rollout could have seismic effects.

In a world where financial gravity always returns, even rockets have limits. Musk may be betting on the stars, but the numbers on Earth are starting to demand action.

If he fails to respond, the penalty could be severe: a $40 billion hit that shakes SpaceX to its very core.

-1745373420-q80.webp)

-1745652400-q80.webp)

-1745833077-q80.webp)

-1745572520-q80.webp)