In a stunning testament to both the volatility of wealth at the top and the overwhelming scale of his financial empire, Elon Musk has seen his fortune shrink by an astonishing $122,000,000,000 in just the first four months of 2025. Yet even after this jaw-dropping loss, Musk's remaining fortune still towers over that of some of the world's most notable billionaires combined, including Amazon founder Jeff Bezos, NVIDIA co-founder Jensen Huang, and entrepreneur Mark Cuban.

Musk's financial journey this year has been nothing short of a roller coaster, one that underscores the heavy dependence of personal net worth on public market dynamics and brand perceptions.

At the end of 2024, Musk was at the very peak of global wealth, holding an estimated $432 billion to his name. His wealth had skyrocketed throughout the year, adding a jaw-dropping $203 billion, a figure that made headlines worldwide and cemented his status as the first person ever to surpass the $400 billion threshold.

The Tesla CEO's financial dominance was so absolute that by the close of the year, he was worth more than the combined value of every MLB, NBA, NFL, and NHL team in America. It was a record-setting period that few believed could falter so quickly.

However, 2025 has proven to be a different story entirely. As Tesla shares began to tumble in the early months of the year, so too did Musk's personal fortune. According to Bloomberg, by April 2025, Musk's net worth had fallen to $310 billion.

While a $122 billion loss in less than four months might seem catastrophic by any measure, the context of Musk's empire tells a different story. Even after losing an amount greater than the GDP of many countries, Musk remains comfortably ahead of his rivals in the billionaire ranks.

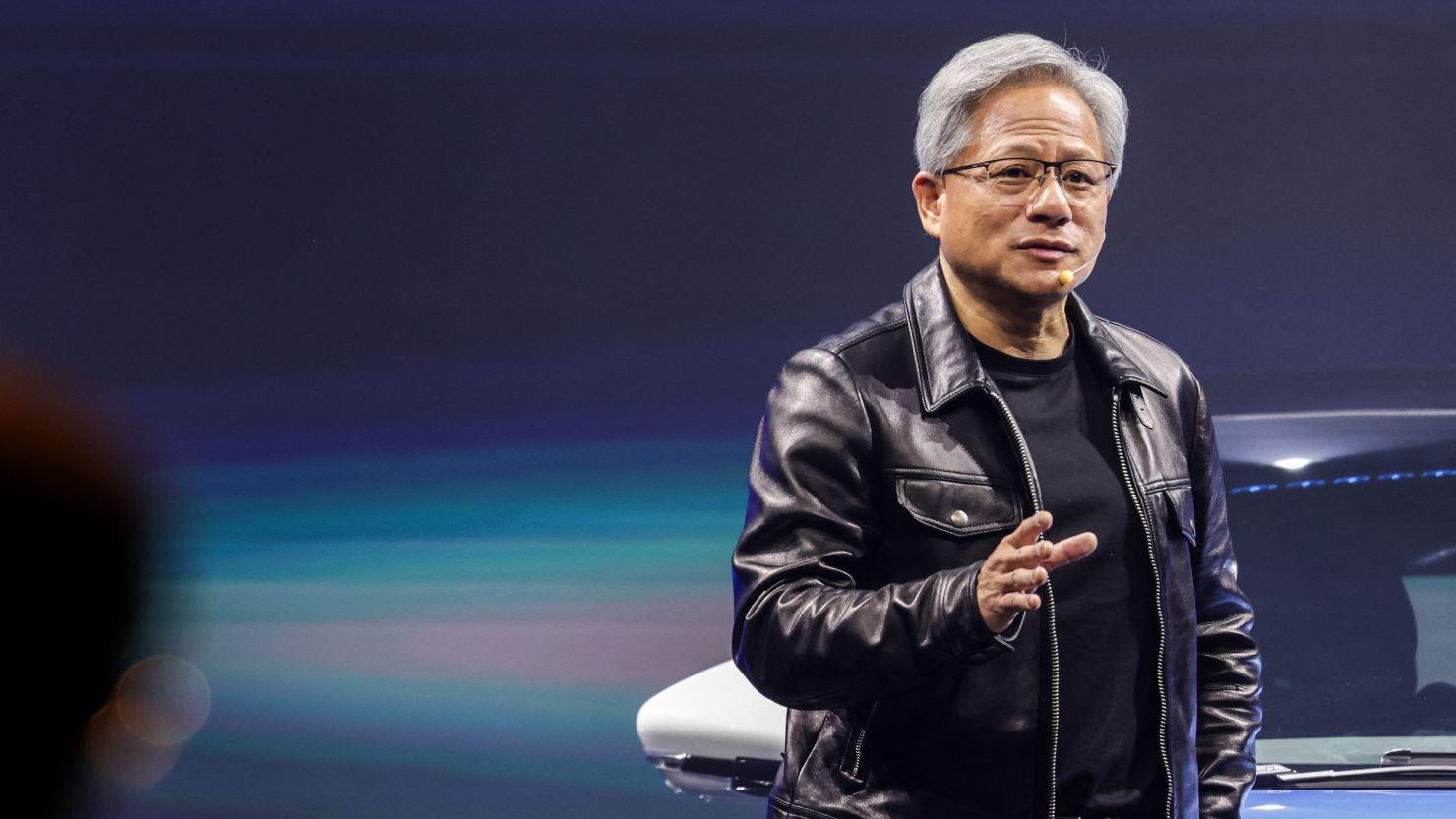

Jeff Bezos, despite his own struggles and a $36.8 billion loss so far this year, holds a comparatively modest $202 billion fortune. Jensen Huang, riding the wave of NVIDIA's dominance in AI hardware but facing market corrections, stands at $90 billion.

Mark Cuban, ever the maverick investor and NBA team owner, holds $7.55 billion. Altogether, their combined wealth totals $299.55 billion, still falling short of Musk's current $310 billion. It is a surreal reality where even after hemorrhaging more than $100 billion, Musk still commands a financial presence unmatched by three of the most recognizable names in global business.

Adding to the almost comical magnitude of Musk's financial standing, even throwing in Palantir CEO Alex Karp, who is worth $9.35 billion, does not bridge the gap. Musk's solitary financial fortress remains larger than the collective fortunes of Bezos, Huang, Cuban, and Karp combined. It is a statement not just about Musk's wealth, but about the absolute outsized role he plays in the modern economic landscape.

The reasons behind Musk's dramatic wealth decline are complex but rooted primarily in the performance of Tesla stock. After ending 2024 with record highs in December, Tesla's stock tumbled throughout early 2025. A key catalyst for the decline was the political upheaval following Donald Trump's presidential victory in late 2024.

While Tesla initially benefited from the excitement of political change, the honeymoon quickly ended as Musk's controversial role in the Trump administration became a public relations nightmare. Appointed to lead the newly established Department of Government Efficiency, Musk's close association with an administration that polarized voters led to boycotts against Tesla and protests at dealerships across America and Europe.

The backlash was swift and unforgiving. Tesla's brand, once synonymous with innovation and eco-conscious aspiration, suffered a blow that translated into declining sales across major markets. Europe, which had been a stronghold for Tesla, saw a sharp decline in new vehicle registrations.

Meanwhile, competition from rising Chinese electric vehicle brands, emboldened by Musk's political controversies, began to take market share.

Tesla shares have plummeted 32.6 percent year-to-date, a staggering reversal for a stock that had seemed invincible just months before. Given that a massive portion of Musk's net worth is tied to his holdings in Tesla, the impact on his wealth was immediate and brutal.

Although Musk also holds stakes in other ventures such as SpaceX, X (formerly Twitter), and his AI initiative xAI, none match the sheer weight of Tesla in determining his financial standing.

This is not the first time Musk has been at the center of a historic wealth collapse. In 2021, Musk set a Guinness World Record for the largest personal fortune loss in history, shedding between $180 billion and $200 billion as Tesla stock corrected from its meteoric rise during the COVID-19 pandemic. Now, only four months into 2025, Musk is on pace to potentially break his own record unless a dramatic turnaround occurs.

Despite these massive setbacks, Musk's future remains far from bleak. Several catalysts loom on the horizon that could yet reignite Tesla's fortunes and, by extension, Musk's personal wealth. Tesla is expected to release updates on its long-delayed next-generation battery technology, a move that could reignite investor enthusiasm.

The Cybertruck ramp-up, although rocky, could see a breakthrough if production issues are resolved. Furthermore, Musk's renewed focus on scaling Tesla Energy and expanding into emerging markets could provide new revenue streams.

SpaceX, meanwhile, continues to dominate the private space industry, with Starlink steadily growing its subscriber base globally and major contracts with NASA and other governments bolstering its financial foundation. The private market valuation of SpaceX, often estimated above $100 billion, remains a substantial and largely untapped reservoir of Musk's wealth.

The wildcard remains Musk himself. Few figures in business history have been as capable of orchestrating dramatic reversals as Musk. His ability to leverage public attention, shape narratives, and launch revolutionary products has repeatedly defied conventional wisdom. Betting against Musk has historically proven costly for critics.

Still, 2025 has exposed the fundamental vulnerabilities in tying personal wealth so tightly to a single brand. Tesla's rise made Musk the richest man alive, but its struggles have shown just how quickly fortunes can change. Investors and analysts are now closely watching how Musk navigates this latest storm, particularly with the added complexity of his political entanglements.

The saga of Musk's wealth collapse and survival is a reminder that while the peaks may be dizzying, the falls can be just as swift. Yet, even when losing sums of money that would cripple entire economies, Musk remains in a league of his own, with a net worth that continues to outshine his most prominent peers. His story in 2025 is far from over. If history is any indication, the next chapters could be even more dramatic than the wild ride that opened the year.

-1745720786-q80.webp)